FARMINGDALE — Interests rates for a voter-approved $1.7 million loan to build a new fire station will likely be higher than expected because of the federal government shutdown, according to town officials.

Town Clerk Rose Webster said Farmingdale was looking to secure a loan from the United States Department of Agriculture before the agency had to close amid the shutdown.

Now, unsure of how long the shutdown will last and hoping to get the project back out to bid before March, the town is looking for loan estimates from local banks. So far, the local lending options have come with interest rates higher than those estimated in December 2018.

Selectmen will discuss the project further at 6 p.m. Wednesday.

Webster said Monday that she did not know USDA’s interest rate, because it hasn’t been updated since the government shutdown and it changed when a new quarter started this month. Last quarter’s rate was 4 percent and estimates based on that rate were presented to voters at December’s special town meeting before they approved the $1.7 million loan.

The government shutdown has slowed funding to a number of USDA programs. The Associated Press reported on Dec. 28 that funding for farm loans, payments to farmers and disaster assistance programs would be put on hold this month. The department also oversees Supplemental Nutrition Assistance Program, or food stamps, and school lunch assistance programs. Those programs have been guaranteed through January and February, respectively.

Other outlets are reporting that loans going to rural homeowners as part of the department’s rural development initiative has been furloughed. The department’s website displays a message saying that it would “not be updated during a lapse of federal funding.”

Al Hodson, left, and and Mark Mccluskey, of A.E. Hodson Consulting Engineers, open bids for a new Farmingdale fire station and pass them along to the committee members Selectman Wayne Kilgore, Assistant Fire Chief Mike LaPlante and Clerk of the Works Rick Seymour on Sept. 25 at the Farmingdale town office.

Kate Dufour, director of state and federal relations at the Maine Municipal Association, said the impacts of the federal shutdown have been relatively limited in Maine so far. She said residents would be more vocal once funding dries up or National Parks are affected during peak seasons.

“If it were the middle of summer, we would’ve heard complaints about federal parks like Acadia (National Park),” she said.

Dufour said the shutdown could eventually affect tax returns and increase the need for local general assistance programs if food stamp funding is tied up for too long.

Loan information presented with Farmingdale’s December warrant article estimated $801,779 in interest, based on a 4 percent interest rate on a 20-year loan from the USDA, with annual payments of $125,089. The total cost of the loan was estimated at $2,501,779. Using this year’s budget, Webster estimated the property tax rate would jump by 59 cents — from $16.30 to $16.89 — per $1,000 of assessed value.

In a late-December 2018 interview, Selectman Jim Grant said the interest rates from the USDA would likely go up. He described the process as more complicated than a bank loan, which would delay the project going back out to bid.

“USDA is a long, drawn-out process,” Grant said. “If we go through USDA, we probably won’t even be going out to bid in March at the earliest. If we can get a competitive rate from a local bank, then we’ll explore that possibility.”

Webster said additional legal fees would be needed to work with USDA. She said the fees could bring the total closer to the bank’s offer for interest, but she had not explored the offers far enough to say for sure.

“It’s a lot more work to do on our end,” she said, citing paperwork and commissioning a USDA-approved attorney.

Ahead of the Dec. 26 select board meeting, the town received loan offers from Skowhegan Savings Bank and Kennebec Savings Bank, but selectmen said they were higher than the 4 percent interest rate. Selectmen did not discuss the loan offers’ specifics, but Grant said one looked more favorable that another. At the meeting, Grant asked Webster to contact Camden National Bank to solicit an offer. He said a town ordinance requires the town solicit at least three bids for projects.

Webster said the town will receive an offer from Camden National Bank, but was not sure it would be available before the next selectboard meeting.

Asked what the offers were, Grant declined to say because Farmingdale was still soliciting bids and publicizing the offers would make it easier for a company to undercut the estimates.

Selectman Wayne Kilgore said Monday that the offers differed only by a fraction of a percent. He said he would support doing business with a local bank unless USDA’s interest rates beats the local banks’ bids by a significant margin.

The site of new Farmingdale Fire Station on Maine Avenue, as seen on May 8, 2018, before it was cleared.

Grant said residents may be upset about the cost jump, but timing was against the town before the special town meeting vote.

“It’s just going to have to be a flat-out statement,” he said of the conversation with citizens about a higher interest rate. “At the time of the meeting, USDA was offering 4 percent. I don’t think we could’ve gotten anything (done before the interest rate changed).”

Kilgore, who has served on the Fire Station Committee overseeing the project, said the town wants to put the project back out to bid in February.

At the special town meeting, residents were worried that the station was designed with too many frills for the department. Although department officials contended that it wasn’t, Kilgore said the Fire Station Committee and engineers from A.E. Hodsdon are still looking to pare down the building. One idea is eliminating a driveway from the station to Second Street, but Kilgore did not know how much money that would save.

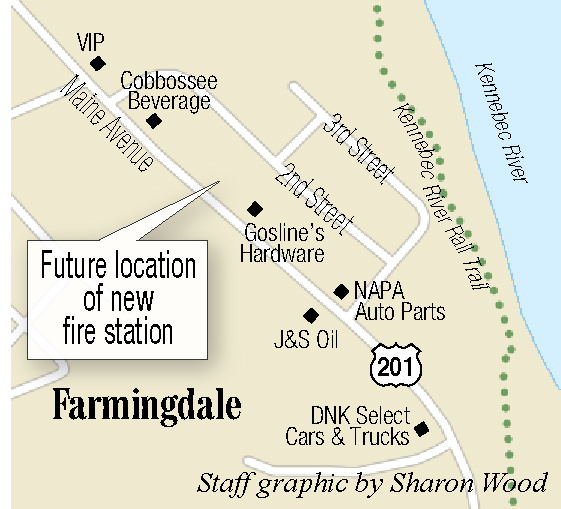

In 2017, voters approved up to $1 million in funding for a new station next to Gosline’s Hardware on Maine Avenue. That funding was never secured because it was insufficient for bids received in September 2018. The bids — all of which were rejected in October 2018 — ranged from $1,543,000 to $1,776,651. Selectman and engineers said skyrocketing material prices were to blame for the high bids.

The lot for the station has been clear since May 2018.

Sam Shepherd — 621-5666

Twitter: @SamShepME

Send questions/comments to the editors.

Comments are no longer available on this story